19

2024

-

12

In the first half of the year, the foreign trade of raw materials for pharmaceuticals has shown steady growth.

In the first half of this year, against the backdrop of global economic stagnation, the market for pharmaceutical raw materials, which are essential for public health, has been relatively stable and less affected by fluctuations. Although the growth rate of the global pharmaceutical market has slowed down, it continues to progress steadily. According to data from the China Chamber of Commerce for Import and Export of Medicines and Health Products, in the first half of 2024, China's total import and export value of raw materials reached 26.52 billion USD, a year-on-year increase of 0.6%. Among them, the export value was 21.34 billion USD, a slight increase of 0.1% year-on-year; the import value was 5.18 billion USD, a year-on-year increase of 2.8%. With the expiration of patents, the generic drug market is ushering in new development opportunities, providing new market space for raw material pharmaceutical companies.

In the first half of this year, against the macro backdrop of global economic stagnation, pharmaceutical raw materials, as essential goods related to public health, have been relatively less affected by market fluctuations, showing a stable growth trend. Although the growth rate of the global pharmaceutical market has slowed down, it continues to move forward steadily. According to data from the China Chamber of Commerce for Import and Export of Medicines and Health Products, in the first half of 2024, the total import and export value of raw materials in China reached 26.52 billion USD, a year-on-year increase of 0.6%. Among them, the export value was 21.34 billion USD, a slight increase of 0.1% year-on-year; the import value was 5.18 billion USD, a year-on-year increase of 2.8%. With the expiration of patents, the generic drug market is ushering in new development opportunities, providing new market space for raw material pharmaceutical companies.

Overall overview: accounting for half of the foreign trade of Western medicine

As a major raw material product category in China's Western medicine import and export products, raw materials account for 50% of the foreign trade of Western medicine. In terms of exports alone, raw materials account for 80% of the export of Western medicine products.

Export value expected to be flat with 2023

From the import and export situation since 2021 (see Figure 1), it can be seen that in recent years, global demand for raw materials has grown rapidly, with foreign trade of raw materials reaching a historical high of 51.56 billion USD in 2022. In 2023, overseas market demand fell, coupled with destocking pressure, leading to a year-on-year decline of over 20% in the export value of raw materials. In the first half of 2024, the export value of raw materials was 21.34 billion USD, basically flat compared to the same period last year. From the current trend, the export value of raw materials for the whole year of 2024 is expected to be flat with 2023, indicating signs of market stability.

Export quantity increased by 23.4% year-on-year

In terms of export quantity, there is a significant difference from the trend of export value. From 2021 to 2023, the export of raw materials continued to grow, with a compound growth rate of 6.8%. In the first half of 2024, the export quantity of raw materials increased by 23.4% year-on-year, and it is expected to continue to rise throughout the year. It can be seen that the current global market demand for raw materials is strong, and China's raw material pharmaceutical industry, with years of technological accumulation, agglomeration effects, and cost advantages, is rapidly meeting market demand, further increasing the export volume of raw materials. At the same time, competition in the raw material pharmaceutical industry is becoming increasingly fierce, and export prices have significantly decreased. This is also why, although the export volume is steadily increasing, the export value remains relatively stable.

Import quantity and value trends are similar

In terms of imports, from 2021 to 2023, the import value of raw materials remained relatively stable, fluctuating around 10 billion USD. In the first half of 2024, the import value of raw materials was 5.18 billion USD, a year-on-year increase of 2.8%. It is expected that the import value for the whole year of 2024 will still maintain a stable growth rate of 2% to 3%. The trend of import quantity is similar to that of import value, basically maintaining around 2 million tons.

Product performance: stable import and export of bulk raw materials

In the first half of 2024, the top three exported products of raw materials were amino acids, antibiotics, and vitamins, all maintaining a trend of rising value and quantity, with export values of 2.26 billion USD, 1.76 billion USD, and 1.51 billion USD respectively.

Mismatch in supply and demand for antipyretic and analgesic products

In contrast, the antipyretic and analgesic products saw a price drop of nearly 25%. Even though the export quantity did not decrease much, the export value dropped by over 27%. The export trend of antipyretic and analgesic raw materials since 2022 shows that global market demand is in a state of oversaturation. Since the export of antipyretic and analgesic raw materials from China reached a peak in 2022, the export volume has gradually decreased from 2023 to the present, but domestic inventory and production capacity are sufficient, leading to a mismatch in supply and demand and continuous price declines. From the year-on-year changes in export prices of ibuprofen, paracetamol, aminophenol, and aspirin in 2023 and the first half of 2024 (see Table 1), it can be seen that the supply and demand imbalance of paracetamol is the most severe, with the largest price drop.

Significant growth in the export of anti-tuberculosis drugs

For example, the export of rifampicin and its derivatives reached 220 tons, a year-on-year increase of 56.5%; the export of ethambutol reached 343 tons, a year-on-year increase of 977%. In terms of the export market for anti-tuberculosis drugs in China, India has long been the largest market, closely related to its high proportion of tuberculosis patients, accounting for 27% of the global total. Notably, in the first half of 2024, the quantity of anti-tuberculosis drugs exported to the Brazilian market increased by 45% year-on-year, making Brazil the second-largest market. Additionally, the import volumes from Vietnam, Pakistan, Mexico, and Egypt also saw significant increases of 62%, 70%, 32%, and 304%, respectively, ranking among the top ten markets.

Peptide hormone raw materials dominate imports

In terms of imports, peptide hormone raw materials, represented by insulin analogs, dominate, with the import value of other peptide hormone HS codes reaching 1.23 billion USD in the first half of the year, accounting for 13% of the total import value of raw materials, driving overall stable growth in raw material imports.

Market operation: overall stable exports, imports show new momentum

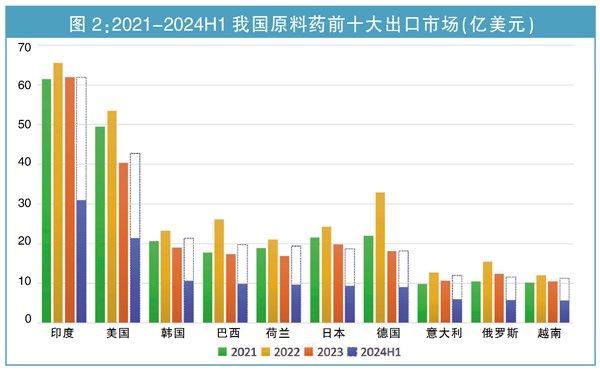

In the first half of 2024, India and the United States remained the top two markets for China's raw material exports. China exported raw materials worth 3.10 billion USD to India, a year-on-year decrease of 3.8%; and exported raw materials worth 2.13 billion USD to the United States, a year-on-year increase of 0.3%.

Strong demand in the third-tier markets

Following closely are the second-tier markets, including South Korea, Brazil, the Netherlands, Japan, and Germany, where China's total exports to these countries remained around 1 billion USD in the first half of 2024. Additionally, third-tier markets such as Italy, Russia, and Vietnam also showed strong demand for China's raw material products, with export values stabilizing between 500 million to 600 million USD.

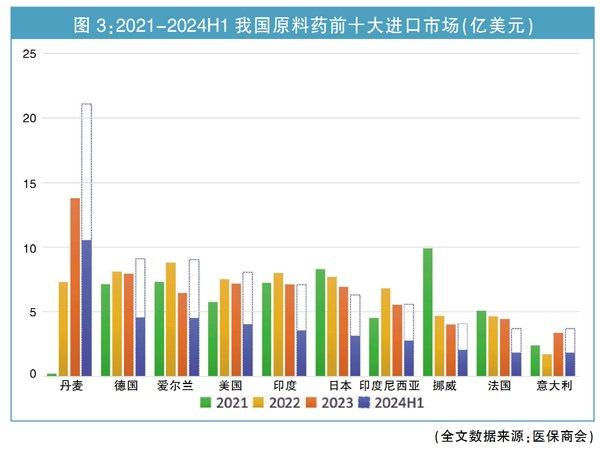

Denmark and Ireland emerge as new players

In terms of the import market, Denmark has emerged as a new player, becoming China's largest import market for raw materials in just two years. In the first half of 2024, China imported raw materials worth 1.05 billion USD from Denmark, a year-on-year increase of 96.3%, and is expected to continue to surge in the second half of the year, leading China's raw material import share.

Ireland's pharmaceutical industry has developed rapidly in recent years. With its stable political and economic environment, favorable tax policies, skilled labor force, and strong R&D capabilities, Ireland has attracted many international pharmaceutical companies to establish production bases there. Among the top 25 global pharmaceutical companies, 24 have invested in Ireland, including Pfizer, Johnson & Johnson, Roche, Novartis, and AbbVie. Ireland has also attracted several Chinese companies, including WuXi Biologics, to invest in Ireland. In the past two years, Ireland has also risen to become a first-tier market for China's raw material imports. In the first half of 2024, China imported raw materials worth 450 million USD from Ireland, a year-on-year increase of 112%, showing significant growth potential.

★★★ Conclusion ★★★

Actively explore the potential of specialty raw materials

Since last year, competition in the raw material market has become increasingly fierce, with price wars becoming a common strategy for capturing market share, especially in the bulk raw material sector, where competition in domestic and international markets has become nearly intense.

In the overseas market, Indian buyers are significantly exerting pressure on prices, and the Production Linked Incentive (PLI) program is subtly influencing the Indian pharmaceutical industry chain. Although the long-term impact of this policy remains to be observed, it undoubtedly intensifies the competitive landscape in the international market. However, the quality assurance accumulated by Chinese active pharmaceutical ingredient companies over years of market testing still holds an advantage in the global market.

Faced with increasingly shortened product life cycles and rapidly changing market demands, it has become increasingly difficult for companies to maintain long-term competitive advantages by relying solely on a single product. Therefore, deepening strategic planning and expanding a diversified product pipeline have become key to sustainable development for companies. They need to actively explore market potential in the fields of specialty active pharmaceutical ingredients and innovative active pharmaceutical ingredients while solidifying their existing market share, in order to open up new growth points and respond to fierce market competition with differentiated strategies.

In the first half of 2024, although Chinese active pharmaceutical ingredients have shown strong resilience in foreign trade, the uncertainty of the international situation and the shift from globalization to a regionalized industrial chain pattern indicate that China's foreign trade in active pharmaceutical ingredients will face more severe challenges. Pharmaceutical companies need to continuously strengthen technological innovation, improve product quality, and actively respond to changes in the international market to maintain competitiveness.

More news