19

2024

-

12

Foreseeing 2024: Analysis of the current market situation, competitive landscape, and development trends of the Chinese API industry in 2024. The API sector is entering an era of high-quality development.

Active Pharmaceutical Ingredients (API), also known as active drug ingredients, are substances obtained through chemical synthesis, plant extraction, or biotechnology, but cannot be directly taken by patients. They are usually processed with the addition of excipients to create medications that can be used directly.

Core data of this article:Production of active pharmaceutical ingredients; Market size of active pharmaceutical ingredients

Industry overview

1. Definition

Active Pharmaceutical Ingredients (API), also known as active drug ingredients, are substances obtained through chemical synthesis, plant extraction, or biotechnology, which cannot be directly consumed by patients. They are generally processed with excipients to create medications that can be used directly.

The refined definition of active pharmaceutical ingredients in ICH Q7: Any substance or mixture that serves as an active ingredient and is used in the production of pharmaceutical products. These substances are intended to exert pharmacological effects or other direct effects in preventing, diagnosing, treating, or alleviating diseases, or to affect the structure and function of the human body.

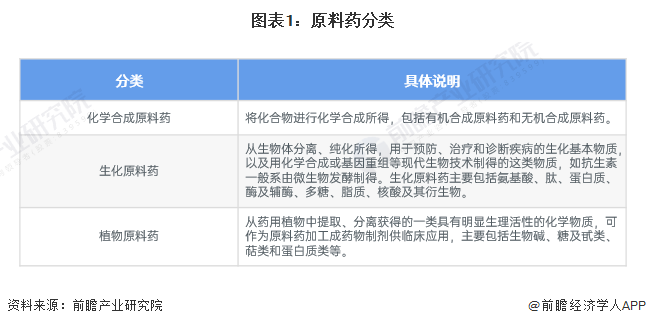

According to the source of active pharmaceutical ingredients, they can be classified into chemically synthesized APIs, biochemical APIs, and plant-based APIs.

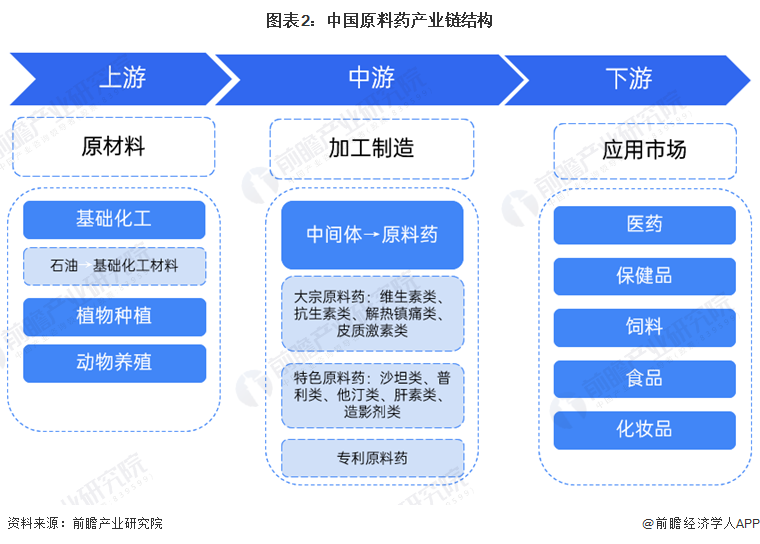

2. Industry chain analysis: The industry chain is long.

The upstream industry of active pharmaceutical ingredients is the basic chemical industry and agriculture, forestry, animal husbandry, and fishery. The active pharmaceutical ingredient industry has a strong dependence on upstream raw materials, and price fluctuations in upstream products directly affect the sales prices and profits of the active pharmaceutical ingredient industry. The downstream of chemical APIs is chemical formulations. Due to social development and aging trends, the overall demand for chemical drug formulations is continuously increasing, which indirectly guarantees the consumption of chemical APIs. Generally, the gross profit margin of the chemical pharmaceutical industry shows an increasing trend from upstream to downstream, with the gross profit margin of APIs being lower than that of chemical inhibitors but higher than that of intermediates. The closer to the downstream the APIs are, the higher the gross profit margin of intermediates.

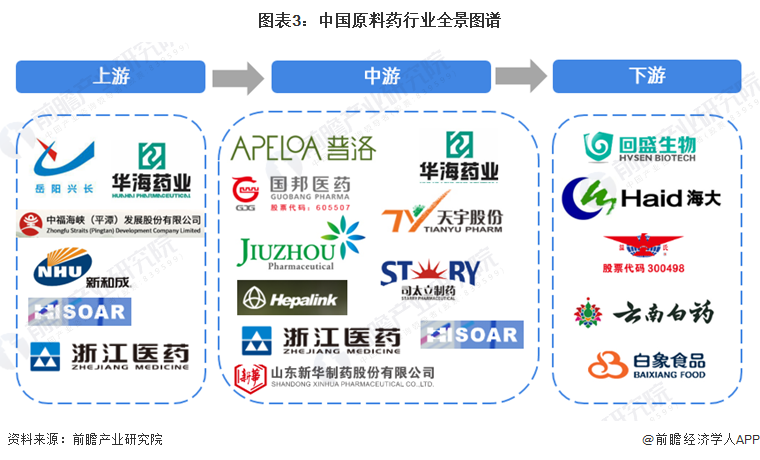

From the perspective of the industry chain ecosystem, upstream raw material companies includeYueyang XinchangXinhongchengand other companies; the midstream includesPuluo PharmaceuticalGuobang PharmaceuticalXinhongchengXinhua PharmaceuticalXinhongchengJiuzhou PharmaceuticalXinhongchengand other companies; the downstream includesHaida GroupYunnan BaiyaoXinhongchengand Baixiang Food and other companies.Industry development history: The industry is becoming more standardized.

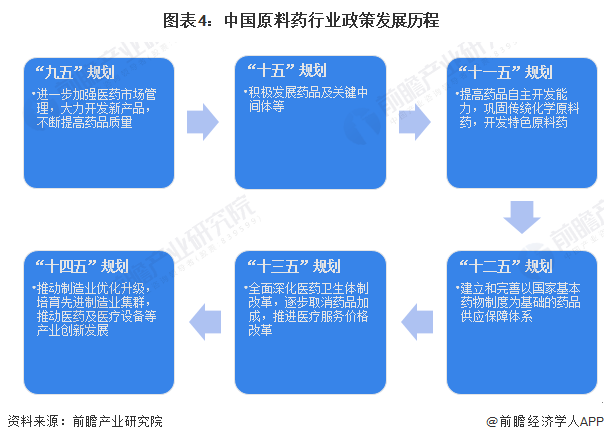

From the evolution of the national economic planning for the active pharmaceutical ingredient industry in China, the 'Ninth Five-Year Plan' proposed to further strengthen the management of the pharmaceutical market, vigorously develop new products, and continuously improve the quality of medicines; subsequently, the 'Tenth Five-Year Plan' to the 'Twelfth Five-Year Plan' emphasized enhancing the independent development capabilities of active pharmaceutical ingredients and establishing a sound drug security system; the 'Thirteenth Five-Year Plan' clearly stated the gradual elimination of drug markups and the promotion of medical service price reforms; the 'Fourteenth Five-Year Plan' explicitly proposed to cultivate advanced manufacturing clusters and promote innovative development in the pharmaceutical and medical equipment industries.

Overall, China's policies regarding active pharmaceutical ingredients have always focused on enhancing R&D capabilities and improving the medical security system.

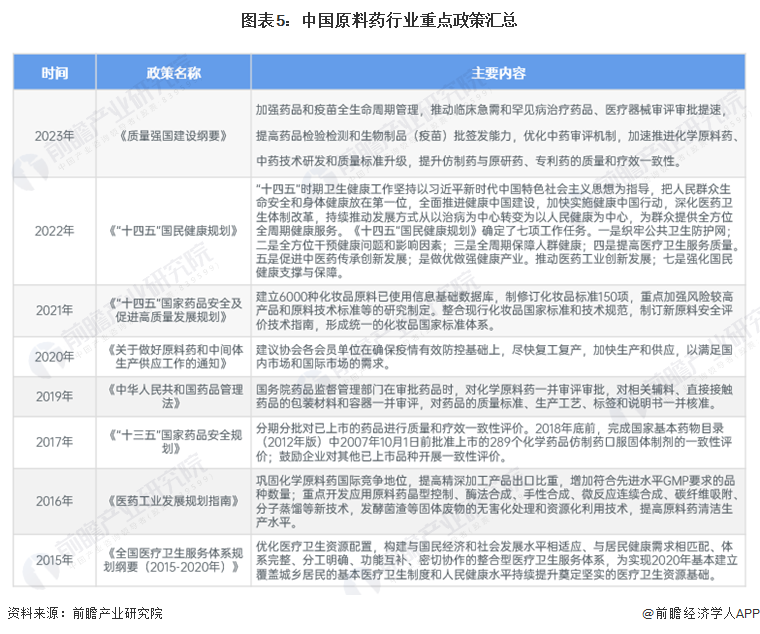

Industry policy background: Policy support, the active pharmaceutical ingredient industry is moving towards high-quality development.

As a basic raw material for drug production, active pharmaceutical ingredients directly affect the quality and production capacity of medicines. In recent years, the state has successively introduced various industrial policies to guide the active pharmaceutical ingredient industry towards high-quality development.

Current status of industry development

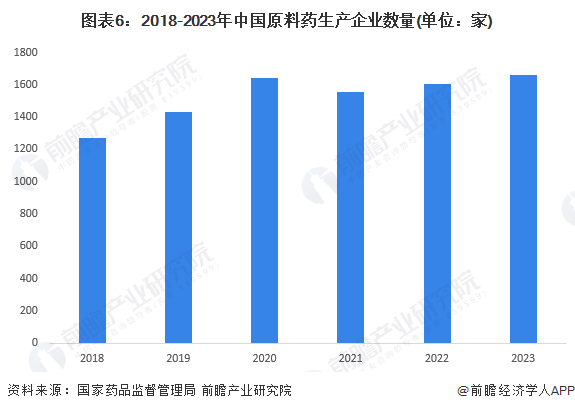

1. The number of active pharmaceutical ingredient production enterprises shows a fluctuating trend.

From 2018 to 2023,

China's chemicalthe number of active pharmaceutical ingredient production enterprises has shown a fluctuating trend. According to data from the National Medical Products Administration, as of 2023, there are a total of 1,661 chemical active pharmaceutical ingredient production enterprises nationwide, with production enterprises in all provinces except Tibet.2. The total production scale of the active pharmaceutical ingredient market has rebounded.

Chemical active pharmaceutical ingredients are the basic raw materials for drug production, directly affecting the quality and production capacity of medicines. Due to the low technical threshold of traditional bulk active pharmaceutical ingredients, the number of domestic traditional bulk active pharmaceutical ingredient production enterprises showed rapid growth in the early stages. According to data from the National Bureau of Statistics, China's chemical active pharmaceutical ingredient industry once experienced a long period of rapid development, with production scale rising to over 3.5 million tons, leading to an oversupply of traditional bulk active pharmaceutical ingredient production capacity. Since 2018, the production of traditional bulk active pharmaceutical ingredients in China has begun to decline, with the total production of active pharmaceutical ingredients by regulated enterprises dropping to 2.3037 million tons in 2018. From 2019 to 2023, the supply production of active pharmaceutical ingredients in China has rebounded, reaching 3.949 million tons in 2023.

3. The market size of active pharmaceutical ingredients has decreased.

In 2023, intense market competition and overcapacity led to a significant decline in the prices of many chemical active pharmaceutical ingredients, especially bulk export products such as vitamins, antibiotics, and heparin. The decline in active pharmaceutical ingredient prices has resulted in a decrease in corporate revenue. According to data from the China Pharmaceutical Enterprise Management Association, the operating income of the chemical active pharmaceutical ingredient industry decreased by 5.9% year-on-year in 2023.

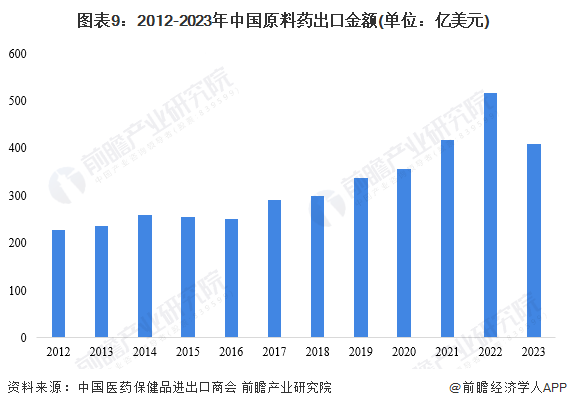

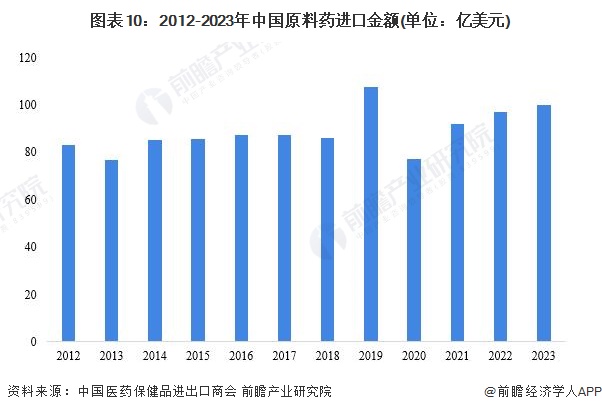

4. The export value of active pharmaceutical ingredients has decreased.There is a significant phenomenon of 'exchanging price for volume' in active pharmaceutical ingredient exports. Several typical bulk active pharmaceutical ingredients have shown an increase in export volume throughout the year, with the average export price decline exceeding the decline in export value. In 2023, China's export value of active pharmaceutical ingredients was $40.909 billion, a year-on-year decrease of 20.66%, with an export volume of 12.4892 million tons, a year-on-year increase of 5.4%, and an average export price decrease of 24.7%. The export value of Western medicine products accounted for 80.11% of the total, remaining basically stable compared to the same period in 2022.In terms of imports, in 2023, China's import value of active pharmaceutical ingredients was $10.022 billion, a year-on-year decrease of 1.5%, with an import volume of 1.9813 million tons and an average import price decrease of 2.6% year-on-year. Against the backdrop of sluggish exports, imports remained relatively stable overall. By market, the top three markets for China's active pharmaceutical ingredient imports are the EU, ASEAN, and the United States. The import value of active pharmaceutical ingredients from India was $711 million, a year-on-year decrease of 11%, mainly due to an 8.2% decrease in import volume.

Industry competition pattern

1. Regional competition pattern

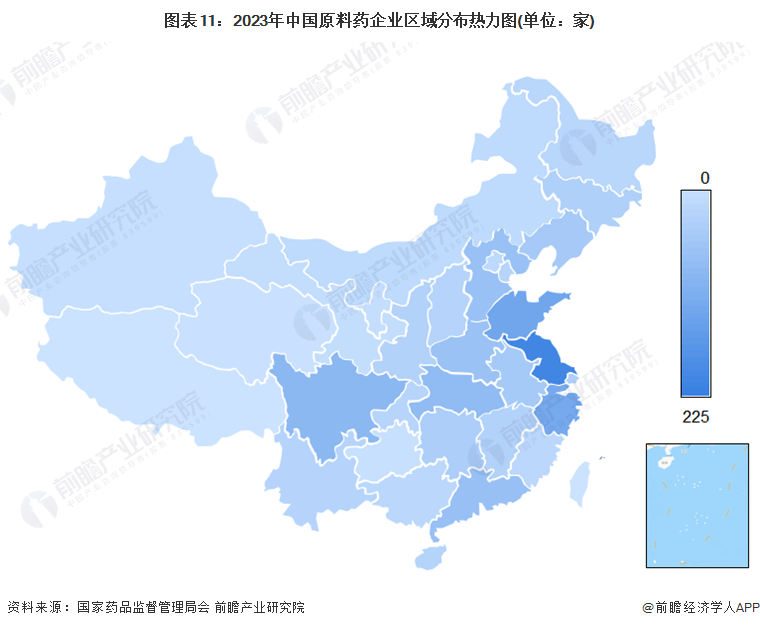

According to data from the National Medical Products Administration, as of the end of 2023, there are a total of 1,661 active pharmaceutical ingredient production enterprises in China, mainly distributed in the central and eastern regions. Among them, Jiangsu Province has the most active pharmaceutical ingredient production enterprises, exceeding 200; Sichuan Province, Shandong Province, and Zhejiang Province also have a relatively high number of enterprises, exceeding 100.

行业竞争格局

1、区域竞争格局

根据国家药品监督管理局会数据,截止2023年底,我国共有原料药生产企业1661家,主要分布在中部及东部地区。其中江苏省原料药生产企业最多,超过200家;四川省、山东省和浙江省企业数量也较多,超过100家。

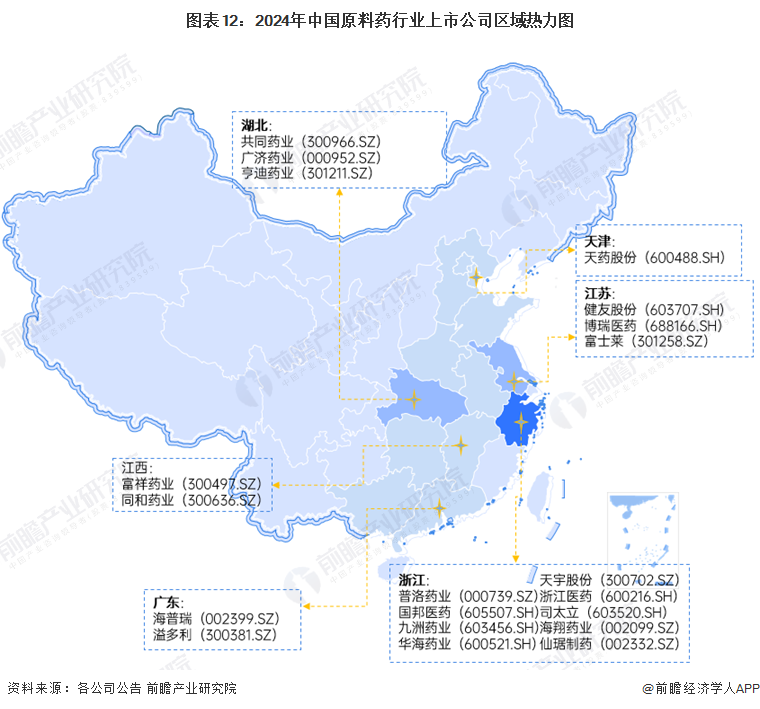

From the perspective of the regional distribution of listed companies in the raw material pharmaceutical industry, Zhejiang has the highest number of listed enterprises, including many leading companies.Guobang Pharmaceutical(000739.SZ),Xinhua Pharmaceutical(605507.SH),and other companies; the downstream includes(603456.SH),Huahai Pharmaceutical(600521.SH) and other leading enterprises. Hubei and Jiangsu provinces also have a considerable number of listed companies in the raw material pharmaceutical industry, with the former havingJointown Pharmaceutical(300966.SZ),Guangji Pharmaceutical(000952.SZ), Hendi Pharmaceutical (301211.SZ) and other listed companies, while the latter hasJianyou Co., Ltd.(603707.SH),Borui Pharmaceutical(688166.SH), Fujilai (301258.SZ) and other listed companies.

2. Competitive Landscape of Enterprises

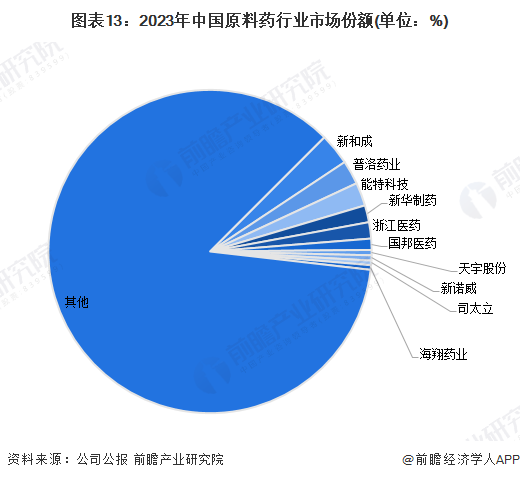

In 2023, in China's raw material pharmaceutical industry,and other companies; the midstream includesthe market share ranks first, with a market share of about 3.2%; Puluo Pharmaceutical ranks second, with a market share of about 2.4%; and Teneng Technology ranks third, with a market share of about 2.3%.

Industry Development Prospects and Trends

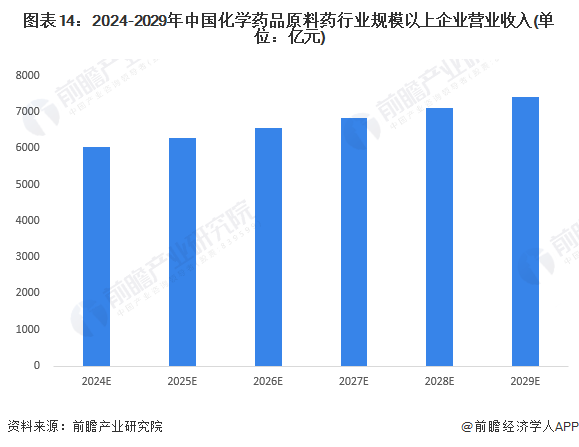

1. Development Prospects: The market size is expected to exceed 700 billion yuan by 2029.

In recent years, the country has vigorously promoted supply-side structural reforms, mainly relying on regulation and guidance to gradually eliminate backward production capacity, encourage raw material pharmaceutical companies to transform and upgrade, while increasing the regulation of the raw material pharmaceutical market, cracking down on illegal price increases and malicious control of sales. On one hand, by reasonably raising environmental protection standards, leading leading enterprises to enhance their process levels and competitiveness, prompting high-pollution non-compliant enterprises to exit the market, reducing low-price competitors in the raw material pharmaceutical market; on the other hand, issuing the "Guidelines for Price Behavior of Shortage Drugs and Raw Material Pharmaceutical Operators" to punish malicious manipulation of raw material pharmaceutical prices. The integration of production capacity, improvement of processes, and maintenance of reasonable profits will lay a more solid foundation for the sustainable and healthy development of China's raw material pharmaceutical industry in the future. Forward-looking predictions suggest that by 2029, the market size of large-scale enterprises in China's chemical raw material pharmaceutical industry will exceed 740 billion yuan, with an average annual compound growth rate of 4.2%.

2. Development Trend: Policy Improvement, Entering a High-Quality Development Era

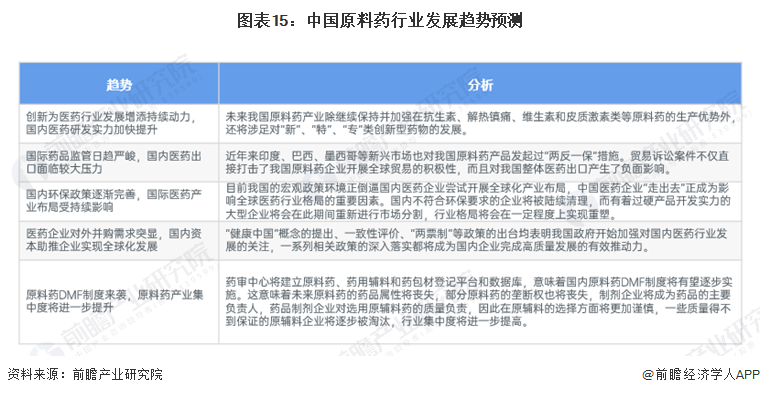

With the changes in the international situation and the improvement of policies, the future trends of China's raw material pharmaceutical industry are as follows:

More news